The governor of South Africa's Reserve Bank, Lesetja Kganyago, recently made some remarkable statements at the World Economic Forum about Bitcoin, suggesting that holding apples or meat as strategic reserves would make as much sense as holding Bitcoin. His comments reveal either a profound misunderstanding of monetary principles or, perhaps more likely, a deliberate attempt to mislead.

Let's examine why his comparison fails on fundamental levels. There are two primary characteristics that determine the effectiveness of a monetary asset as a store of value: durability and scarcity.

First, consider durability. Kganyago's suggestion of apples and meat as strategic reserves immediately falls apart - these are perishable goods that rot, decay, and lose value over time. This is precisely why humanity, through thousands of years of market discovery, gravitated toward gold as a store of value - it doesn't rust, rot, or degrade. Similarly, Bitcoin, being digital and decentralized, achieves perfect durability. The encryption that secures Bitcoin today will remain unbreakable for generations to come.

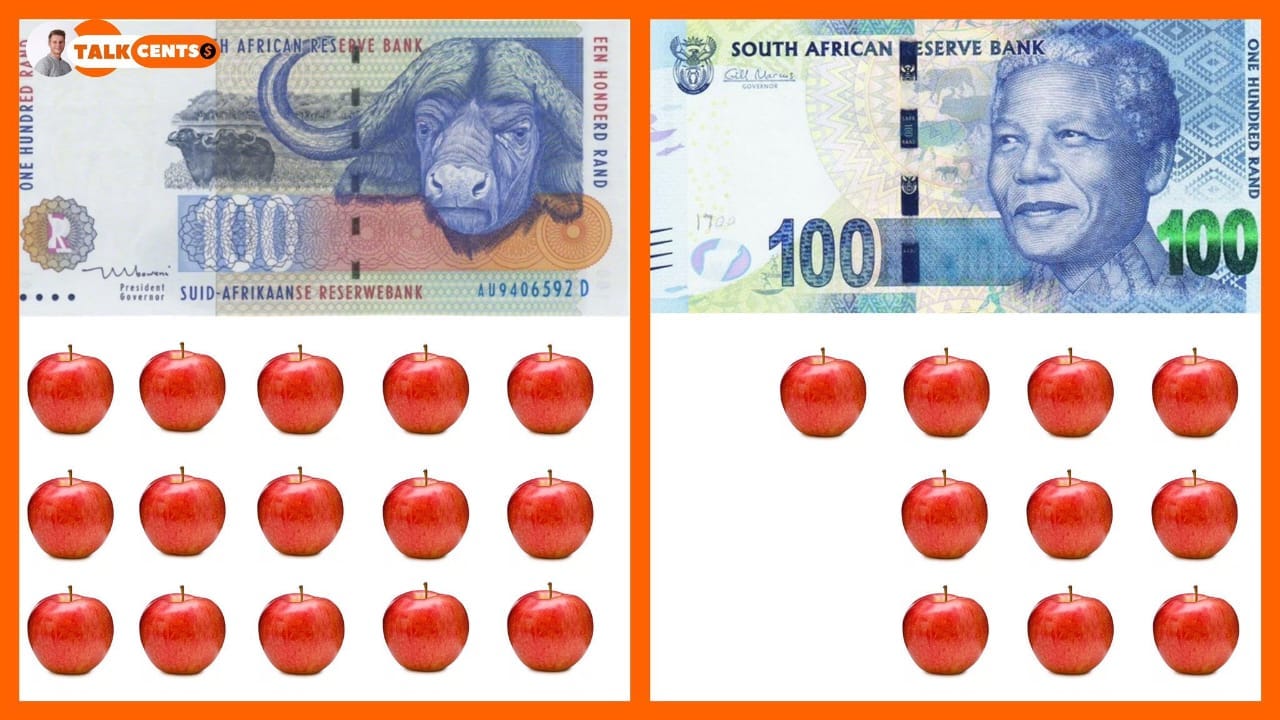

Second, and perhaps more importantly, is the question of scarcity. Here's where Kganyago's argument becomes almost comical. If South Africa announced tomorrow that it would hold apples as a strategic reserve, what would happen? Every farmer in the country would expand their apple orchards, effectively inflating the supply and destroying the very value the reserve was meant to protect. The same applies to meat production. The ease of increasing supply makes these commodities particularly poor stores of value.

This is where Bitcoin's fundamental innovation becomes clear. Its supply is mathematically capped at 21 million coins, enforced by consensus rules that cannot be altered. While the Reserve Bank can (and does) print Rand at will, leading to its dramatic depreciation against major currencies, Bitcoin's supply schedule remains immutable - the 21 million coin limit is set in stone.

Perhaps it's not surprising that Kganyago chose these particular examples. After all, the current fiat system he oversees shares more characteristics with perishable goods than he might care to admit. The Rand, like all fiat currencies, has no inherent durability - its value erodes through inflation, much like an apple rotting on a shelf. And like agricultural products, its supply can be increased at will, though in this case by central bankers rather than farmers. The comparison becomes even more striking when we consider that the South African government, while allowing alternative payment systems like Bitcoin to exist, maintains an exclusive monopoly on the creation of the official national currency - imagine if they applied the same logic to apple production, making it illegal for anyone but the state to grow the "official" South African apple, with all other varieties relegated to alternative status. This reveals the true nature of their system: not just inflationary, but fundamentally based on state control over the national money supply.

The irony here is that while Kganyago mocks Bitcoin, South Africans are increasingly turning to it as a hedge against the very monetary instability his institution creates. As I've observed during my travels through South Africa, even businesses at historical sites like the Voortrekker Monument now accept Bitcoin as payment. This grassroots adoption speaks volumes about which monetary system people trust when given a choice.

In closing, I find it telling that the head of South Africa's central bank would make such fundamentally flawed arguments. It suggests either a concerning lack of understanding about monetary principles or, more worryingly, a deliberate attempt to discourage South Africans from seeking alternatives to the system of currency debasement over which he presides.

I'm excited to announce that I'll soon be heading to South Africa for an extensive reporting trip. My focus will be documenting local communities that have embraced Bitcoin as their path toward financial sovereignty. From small businesses to farming communities, I'll be exploring how South Africans are using Bitcoin to protect themselves against the continued devaluation of the Rand.

This kind of independent journalism is only possible because of readers like you. If you value these insights and want to support more on-the-ground reporting from South Africa, please consider becoming a paid subscriber. For those already familiar with Bitcoin, you can also support this work through a Bitcoin donation. Every production I make is funded entirely by you, my readers, which allows me to maintain complete independence from corporate or institutional influences.

Make sure to subscribe to not miss this upcoming series of reports. I promise to bring you the kinds of stories and perspectives on South Africa that you won't find in mainstream media.

Best regards,

Jonas Nilsson

Bitcoin:

bc1q00l2yrwrx0u9l2l9g9f5wtkl904txklpev4hd8